Investing in shares for the first time? This step-by-step beginner's guide will show you the steps you need to take to invest in the share market.

Mentioned: BHP Group Ltd (BHP) , Rio Tinto Ltd (RIO)

Investing in shares is a proven way to build wealth over the long-term but there are risks involved. If you’re just getting started, here’s a step-by-step guide to help you choose and buy shares in Australia.

You’ll learn about the different types of shares (dividend, growth, value), how to determine the best shares for you, how to identify if a share is ‘cheap’ or not, the differences between shares and Exchange Traded Funds (ETFs), Australian shares vs international shares, how to buy and sell shares, how much money you need to start investing in shares and more.

Key takeaways

Purchasing a share of a company makes you a partial owner of the business.

Shareholders are entitled to the profits, if any, generated by the company after employees, vendors, and lenders are paid. Because shareholders only get the profits left over after everyone else is paid, they shoulder more risk than bondholders, who get paid a fixed amount regardless of how well a company does––unless it goes bankrupt.

Companies usually pay out their profits to shareholders in the form of dividends, or they reinvest the money back into the business. Dividends provide shareholders with a cash payment, and reinvested earnings offer shareholders the chance to receive more profits from the underlying business in the future.

Shares, stocks and equities are often used interchangeably to mean ownership in a company.

Technically, a share is a unit of a stock.

E.g. an investor may own 20 shares of a company’s stock.

Many new investors might put their money in shares because they offer the best potential long-term returns. If you have years or decades to invest, as many beginning investors do, you can invest in shares and see your dollars multiply over the time period.

This chart shows the returns of different asset classes over more than 30 years.

Cash—RBA Bank accepted Bills 90 Days; Aust. Fixed Interest—Bloomberg AusBond Composite 0+ Yr TR AUD; Intl. Fixed Interest (H)—BarCap Global Aggregate TR Hdg AUD; A-REITs—S&P/ASX 300 A-REIT TR; Global REITs (H)—UBS Global Investors Ex AUS NR Hdg AUD; Aust. Equity—S&P/ASX 200 TR; Small Caps—S&P/ASX Small Ordinaries TR; Intl. Equity—MSCI World Ex Australia NR AUD

Past performance does not necessarily indicate a financial product’s future performance. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.

If you had kept $1 in cash (maroon line) from July 1989 to April 2023, that would have turned into around $4.

On the other hand, if you had invested it into Australian shares (dark green line), that same $1 would have turned into $18.

Of course, this is not to convince you to pull all of your cash out of the bank and put it into Australian shares. Rather, it illustrates that though cash has almost always been seen as a ‘safe’ option, there is always a trade-off when it comes to risk. And in this case it is the risk of not achieving your goals.

As mentioned previously, your money may be safe in the bank but its purchasing power also risks being eroded by inflation.

Inflation is the sustained rise in the price of goods and services over time. In other words, that dollar you possess today is worth less than a dollar tomorrow. As the value of money decreases, the price of goods and services in the economy increase.

Many of the places we consider ‘safe’ to keep our money (i.e. the banks) don’t necessarily award interest equal to inflation, forcing you to look elsewhere just to maintain your purchasing power.

Cash might feel like a comfortable option, but it may mean the risk of a less comfortable retirement or the risk of compromising on other lifestyle goals in the lead-up to retirement.

You can start investing in shares with a modest amount of money. Stockbrokers in Australia such as CommSec (the Commonwealth Bank’s online stockbroking subsidiary) let you invest in shares with as little as $500.

However, you should pay attention to brokerage fees, which are charged in addition to the shares themselves. You may choose to wait until you can purchase larger amounts of shares to save on overall fees paid.

For example, instead of buying $500 worth of shares two times in a year ($1,000 total) and paying a total brokerage fee of 2 x $10 = $20, you may choose to save up and purchase $1,000 at once.

This would halve the total brokerage fee you pay (1 x $10 = $10) assuming the broker charges the same fee for buying $500 or $1,000 worth of shares.

Exchange-traded funds (ETFs) are collections of investments that trade just like a share on an exchange.

Since ETFs debuted in 1993, investors have flocked to them because they’re typically easy to buy, transparent, and can offer instant diversification into global equity and bond markets. ETFs can help investors quickly build and easily manage a diversified investment portfolio.

However, some investors may prefer investing in individual shares. Shares can allow investors to capitalise on opportunities they see within specific regions, sectors, and share sizes (small / mid / large cap), which may be difficult to do with a professionally managed collective investment like an ETF. This can help investors improve their investment returns.

What’s the best share to buy?

Well, that answer can depend on various factors, including your current investments, your age, how much you have to invest, your investing goal, your personal investing preferences and much more.

This is why we at Morningstar take an investor-focused approach, rather than an investment-focused approach.

And we do that by starting with your goals for investing and then working backwards to what investments are aligned with that goal.

Here are three steps to help you choose the right shares for you.

Start by taking stock of where you are starting off from and assess your assets and debt levels using our handy Net Worth Worksheet.

Our Net Worth worksheet helps give a snapshot of your current position

A personal cash-flow statement provides a point-in-time snapshot of what income comes into your household from your job and/or any other sources, as well as what you’re spending and saving.

This helps you determine whether your spending and savings patterns align with your long-term goals.

Here’s a template you can use to create your personal cash-flow statement.

Find out what’s happening with your money with our Personal Cash Flow Statement

Define and estimate the cost of each of your goals. For short- and even some intermediate-term goals, this should be straightforward.

Estimating the cost of multiyear, long-term goals like retirement is trickier. The big wild card is inflation: While it’s currently quite low by historical standards, it is reasonable to assume at least a 2 per cent to 3 per cent inflation rate for longer-term goals. At Morningstar we have a 2.6 per cent yearly inflation estimate.

Complete the Goal Planning Worksheet to give you an idea of your different goals, when you hope to achieve them and how much they are likely to cost.

Write down your investment goals in our Goal Planning Worksheet

Calculate what you need to earn to meet your goals using the numbers from the three steps above and the required rate of return calculator found inside Morningstar Investor (Sign up for a FREE 4-week trial^ here to get access. No credit card needed).

Calculate your required rate of return with the calculator found in Morningstar Investor

Your required rate of return will give you an indication of the level of investment risk that you need to take to meet your goals and any lifestyle changes you may need to make to ensure you reach your long-term goals.

It can also help you understand whether your goal is feasible based on historical average returns that have been generated from different investments.

For example, if you complete these steps and your required rate of return is 50%—dramatically higher than average historical returns for shares and other major asset classes—then it may be time to re-evaluate your goals.

Shares are not the only types of investments available.

In fact, there are many other asset classes which investors can and should include in a diversified portfolio.

These include ‘growth’ assets such as shares, property and infrastructure, which are assumed to achieve higher returns on average over the long time, but have higher volatility associated.

They also include ‘income’ or ‘defensive’ assets, such as cash, government bonds and corporate credit, which are assumed to have lower average returns but with lower volatility.

While most retail investors focus on what individual investments will go into their portfolio, the combination of asset classes you select has an enormous influence on your returns.

And what asset allocation you select should be influenced by your required rate of return.

The higher your required rate of return, the more growth assets need to be in your portfolio.

To determine what percentage to allocate to each asset class takes a little nuance. We provide Morningstar Investor members with 5 pre-defined asset allocation models based on different risk and return profiles (Sign up for a FREE 4-week trial^ here to get access. No credit card needed).

Five pre-defined asset allocation models based on different risk and return profiles are available inside Morningstar Investor.

Now that you’ve determined how much of your investment portfolio should be made up of shares, it’s time to choose which shares to go in there.

To do this you need to outline the approach you want to take to reach your goal and selection criteria for investments.

For example, you may be looking to invest for income and want to focus on blue chip companies you are familiar with, with a dividend yield of at least 5%, and a consistent track record of dividend payments. You want to take advantage of franking credits available on Australian shares, but still want exposure to international dividend shares to ensure you diversify your income streams across geographies and sectors. You also want to purchase shares when they are trading at a discount to their fundamental value to give you a margin of safety.

Or you may be investing for capital growth and want to concentrate your investments into fast-growing companies with a small market cap and strong competitive advantage, in a handful of sectors you know well. Environmental, Social and Governance (ESG) sustainability factors are an important factor in your selection process.

Our Investment Policy Statement tool inside Morningstar Investor (Sign up for a FREE 4-week trial^ here. No credit card needed.) can help you document this and keep it top of mind to help you stay on track when selecting shares and managing your portfolio.

The Investment Policy Statement tool inside Morningstar Investor helps you focus on your goal and what’s important to you

Once you’ve done this, you can start searching for shares aligned with your goals, approach and criteria.

At Morningstar, we take an owner-oriented approach to investing in shares.

You see when investors buy shares, we don’t think they’re just buying a name on a screen. Rather, they’re buying partial ownership in companies. As such, we think it’s important to understand a company’s fundamentals before purchasing its shares.

This approach can help you no matter what your goal or selection criteria is, by helping you look beyond potential noise caused by short-term factors and hype, and find quality shares to invest in long-term.

It boils down to three basics:

Let’s unpack that a bit.

We encapsulate our opinion of a company’s competitive advantages in the Morningstar Economic Moat Rating. From our perspective, these are the types of companies that are able to effectively fend off competitors and earn high returns on capital for years to come. A company whose competitive advantages we expect to last more than 20 years has a wide moat; one that can fend off their rivals for 10 years has a narrow moat; while a firm with either no advantage or one that we think will quickly dissipate has no moat.

Our fair value estimates are our take on what we think a company’s shares are worth. We look beyond fleeting metrics, such as a company’s recent earnings or any stock price momentum. Rather, we calculate fair value estimates based on how much cash we think a company will generate in the future. Our fair value uncertainty rating--depicted as low, medium, high, very high, or extreme--depicts the level of uncertainty around our fair values estimate, based on things like a company’s sales predictability, operating and financial leverage, and exposure to contingent events.

Lastly, the Morningstar Rating for stocks indicates whether a stock is undervalued (4 or 5 stars), fairly valued (3 stars), or overvalued (1 and 2 stars) based on where a stock’s market price is relative to our fair value estimate, adjusted for uncertainty.

Star ratings are a quick way to tell whether the current price of a stock is a good one, and that is separate from whether the company itself is a good one.

Star ratings are meant to be used in conjunction with the Morningstar Economic Moat Rating and other fundamental metrics to help you make a decision about investment based on many factors.

Morningstar Investor’s premium share screener allows you to screen over 48,000 ASX and global shares, to find investments which meet your specific criteria.

Comprehensive, easy-to-use filters allow you to find companies meeting your criteria such as sector, size (e.g. blue chip, small cap), dividend yield, franking percentage, Morningstar analyst rating and more.

Detailed analyst reports on over 1,600 companies allow you to understand the long-term fundamentals and outlook for the business before making an investment decision.

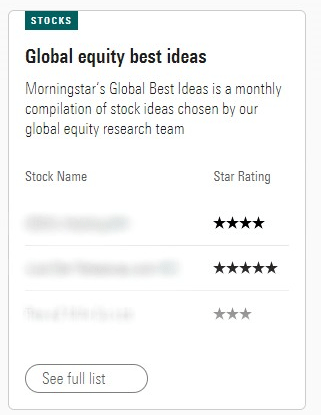

The Global Best Stock Ideas list is compiled by Morningstar’s equity analysts every month. To earn a spot on the list, these stocks have high analyst conviction in their future prospects and are trading at a price significantly below what our analysts calculate them to be worth.

Additionally, analysts consider the stock’s moat rating. This rating is an indication of the analyst’s expectations for the company to maintain a sustainable competitive advantage. A wide moat rating is awarded to companies that are expected to maintain and grow their earnings for at least the next 20 years, a narrow moat for the next 10 years.

To access Morningstar’s Global Best Stock Ideas list, as well as our Premium investment screener to find other stocks that meet your investment criteria, sign up for a FREE 4-week trial^ of Morningstar Investor.

Investment funds usually have at around 50 different holdings and often upwards of 100—unless the manager is running a particularly concentrated portfolio.

Investment funds do this to diversify their portfolio and therefore reduce risk. For example, in a generic, equally weighted portfolio of 50 stocks, a 10% drop in price for one individual holding results in only a 0.2% decline for the overall portfolio.

Investment funds can do this as they have resources to research and manage each individual investment closely, as well as the scale to justify investment costs such as transaction costs and commissions.

However, as an individual investor, do you need to hold as many shares in your portfolio to achieve the benefits of diversification?

Based on Morningstar’s research, owning 20-30 stocks will, on average, diversify the bulk of the unsystematic risk (the unique risk associated with investing in any single security) that investors face.

‘Value’ stocks are those that are seen to trade at a lower stock price relative to the company fundamentals. These stocks have low market valuations in relation to some multiples, such as:

These companies also tend to, on average, pay higher dividends.

Growth stocks are stocks that are expected to grow at a higher rate than the market and have higher multiples of the market average, based on the ratios cited above. These higher valuations are generally justified by higher rates of expected growth in sales, earnings or cash flows.

Companies in sectors such as technology or healthcare (typically growth sectors) tend to fall into this category.

Market capitalisation is the value of a company’s outstanding stocks—outstanding shares are issued shares owned by stockholders.

Market cap is calculated by multiplying the number of a company’s shares outstanding by its price per share.

Investors use market capitalisation to divide listed stocks into three broad categories according to size: large market cap, mid market cap and small market cap.

Large caps: these are the biggest companies on the ASX by market cap. They represent more than half of the Australian share market by market cap. The market cap of these securities is typically over $10 billion. Investors may also refer to these stocks as “blue chips”—meaning stocks of strong, well-established companies that have demonstrated their ability to pay dividends in both good and bad markets.

Mid caps: these are next biggest set of companies on the ASX by market cap. The market cap of these securities is between $2 billion and $10 billion.

Small caps: these companies typically sit outside of the top 100 listed companies by market cap. The market cap of these securities is between $100 million and $2 billion.

Spreading your holdings among stocks of different capitalisation levels is a good way to get diversification in your portfolio, since small caps and large caps typically present different growth and risk profiles. Large caps are usually less risky, but their growth potential is somewhat limited, whereas small caps give you the opportunity to get super-sized growth, but you may be in for a bumpy ride.

If you’re an income investor—attempting to generate a steady income via dividend-paying stocks—it’s important to use market capitalisation to evaluate a stock, as large caps are usually associated with stable companies that regularly pay dividends, while small caps generally pay no dividends.

Certain sectors of the economy may perform better than others at different points in the business cycle.

For example, if during recessionary periods, companies in the financial sector typically experience a downturn, while defensive sectors with more ‘recession-proof’ demand like healthcare, tend to perform relatively better.

You can take advantage of this by investing in sectors which are undervalued and therefore pick up quality companies at a bargain price.

You can also use this to your benefit by diversifying your investments across different sectors. This can help lower the volatility of your portfolio.

At Morningstar, we categorise shares into the following eleven sectors:

Basic Materials

Companies that manufacturer chemicals, building materials and paper products. This sector also includes companies engaged in commodities exploration and processing.

Companies in this sector include BHP Group Ltd (ASX: BHP) and Rio Tinto Ltd (ASX: RIO).

Communication Services

Companies that provide communication services using fixed-line networks or those that provide wireless access and services. This sector also includes companies that provide internet services such as access, navigation and internet related software and services.

Companies in this sector include Telstra Group Ltd (ASX: TLS), REA Group Ltd (ASX: REA), Meta Platforms Inc (NASDAQ: META), Netflix Inc (NASDAQ: NFLX), and Alphabet Inc Class A (NASDAQ: GOOGL).

Consumer Cyclical

This sector includes retail stores, auto & auto parts manufacturers, companies engaged in residential construction, lodging facilities, restaurants and entertainment companies.

Companies in this sector include Amazon.com, Inc. (NASDAQ: AMZN), Wesfarmers Ltd (ASX: WES) and Aristocrat Leisure Ltd (ASX: ALL).

Consumer Defensive

Companies engaged in the manufacturing of food, beverages, household and personal products, packaging, or tobacco. Also include companies that provide services such as education & training services.

Companies in this sector include Woolworths Group Ltd (ASX: WOW) and Coles Group Ltd (ASX: COL)

Energy

Companies that produce or refine oil and gas, oil field services and equipment companies, and pipeline operators. This sector also includes companies engaged in the mining of coal.

Companies in this sector include Woodside Energy Group Ltd (ASX: WDS), Santos Ltd (ASX: STO) and Origin Energy Ltd (ASX: ORG).

Financial Services

Companies that provide financial services which includes banks, savings and loans, asset management companies, credit services, investment brokerage firms, and insurance companies.

Health Care

This sector includes biotechnology, pharmaceuticals, research services, home healthcare, hospitals, long-term care facilities, and medical equipment and supplies.

Companies in this sector include CSL Ltd (ASX: CSL), Sonic Healthcare Ltd (ASX: SHL) and Cochlear Ltd (ASX: COH).

Industrials

Companies that manufacture machinery, hand-held tools and industrial products. This sector also includes aerospace and defence firms as well as companied engaged in transportations and logistic services.

Companies in this sector include Transurban Group (ASX: TCL), Brambles Ltd (ASX: BXB) and Qantas Airways Ltd (ASX: QAN).

Real Estate

This sector includes mortgage companies, property management companies and REITs.

Companies in this sector include Scentre Group (ASX: SCG) and Goodman Group (ASX: GMG)

Technology

Companies engaged in the design, development, and support of computer operating systems and applications. This sector also includes companies that provide computer technology consulting services. Also includes companies engaged in the manufacturing of computer equipment, data storage products, networking products, semiconductors, and components.

Companies in this sector include), Apple Inc (NASDAQ: AAPL), Oracle (NYSE: ORCL), Salesforce (NYSE: CRM) and Microsoft Corp (NASDAQ: MSFT).

Utilities

Electric, gas, and water utilities. Companies in this sector include APA Group (ASX: APA) and Meridian Energy Ltd (ASX: MEZ).

While Australian shares have certain advantages, such as a higher average dividend yield than traditional international shares (plus favourable tax treatment of dividends in the form of franking credits), international shares can play an important part in an investor’s asset allocation mix.

And thanks to technology and increased competition, investing in international shares has never been more accessible to individual investors.

By investing overseas, investors can mitigate concentration risk and gain exposure to stocks that are otherwise underrepresented in Australia, such as technology. This is especially important for the Australian market which is concentrated in two sectors—financials and resources. By spreading your investments and risks strategically you insulate yourself against the potentially nasty side-effects of one market falling.

The Australian share market is concentrated in the Financial Services and Basic Materials sectors)

Concentration risk also extends past your investments. For most people, working and living in a country means the local economy can play a big role in determining your financial well-being.

A downturn in the local economy can lead to (or be caused by) depressed prices in housing and the share market.

At the same time, your livelihood could suffer as economic upheaval often leads to wage cuts and job losses. And if you’re on the eve of retirement it could dramatically alter your circumstances.

The second benefit of international investing is accessing undervalued opportunities when domestic markets are overvalued.

Company shares are sold via financial professionals known as brokers who will take your order and execute the trade on your behalf. Online trading has made buying Australian shares simple. You can do the whole thing from your smartphone.

But with tens of brokers on the market, how do you know which one to choose? Every broker offers a different level of service, priced accordingly, and you must choose the one that best suits your needs. The best platform for you might not be the best platform for someone else.

Broadly speaking, there are two types of brokers:

1. Full-service brokers—before there were smartphones and high-speed internet, broking typically happened over the phone. You’d call up your broker, chat to them about what you wanted to trade; they would offer advice (for a fee) and execute your trade on the market.

Full-service brokerages such as this still exist and offer advice on security selection, provide research, access to new investment opportunities like initial product offerings, and advise on portfolio construction. A good broker will also contact you if something big has changed in your portfolio, or if they spot an opportunity. However, all this comes at a price. Commissions for full-service brokers are much higher than online brokers.

2. Online discount brokers—Online brokers—or share-trading platforms—allow you to execute the trade yourself. They offer simple, online, no-frills access to share trading. The major banks have broking websites that allow you to use the funds in your bank account to buy shares. Several non-bank brokers such as Interactive Brokers, IG Markets, CMC Markets, SelfWealth and Bell Direct are also available.

Although the service is much cheaper than using a full-service broker, you may need to separately buy investment insight and research to give you guidance about which shares to purchase. Some discount brokers now offer services such as portfolio management, market data, reporting tools and research for an additional fee.

In this article, we’ll focus on choosing an online broker.

Investment Options

Before you set up an account, consider what you plan to invest in. Once you know that, focus on those firms that have the broadest array of that investment type at the lowest possible cost.

For example, you may invest heavily in certain international share markets, and want a broker who can provide you with access to them.

Trading Commissions

Consider the charges you’ll pay to buy and sell. Bear in mind your own trading style because that will determine how much importance to place on trading commissions.

If you’re a frequent trader, you’ll want to find the cheapest price out there. (Just be sure to stay attuned to whether you’re actually adding or subtracting value with that frenetic strategy.)

But if you plan to keep it simple and just let your investments ride, then commissions may not matter as much. Other considerations, such as breadth of the investment line up and ongoing account fees should be more important.

Account size also plays a role when determining the importance of commission rates. The smaller your trade, the more significant any commissions will be, in percentage terms.

Fees

In addition to fees to trade securities, be sure to read the fine print to identify any additional charges. These fees can run the gamut--maintenance, activation, monthly fees, custodial fees, conversion fees, transfer-out fees, as well as inactivity and termination fees. Keep in mind, too, that some discount brokerages charge a fee for dividend reinvestment.

Share ownership

Most brokers offer CHESS Sponsored shares. This means that when you trade shares, the exchange has a record of you owning those shares directly. This is tracked via your unique Holder Identification Number. However, some brokers operate under a custodian model, meaning that they hold the shares on your behalf.

User Interface

Online brokerage firms may allow you to print out portfolio reports to view your account balance as well as any realised and unrealised gains, and dividend records. If the firm offers online trading and/or a mobile trading platform, make sure that it is easy to use and navigate. For those who aren’t as technologically savvy, it may be counterproductive to sign up with online brokerage firms that boast a ton of bells and whistles but require some tech-savvy to manoeuvre.

Tax is part and parcel of investing and making profit and income. It is also a large determinant of your total return outcomes, as it can take away almost half of the return from investments.

Superannuation is one of the most tax effective ways of investing and saving for retirement. What about investors who have investments for goals outside of retirement?

Outside of investing as an individual, there are two main vehicles that you can invest through that have differing tax implications—trusts and companies. Deciding which vehicle to invest in can have major ongoing cost and tax implications. The major differences to consider before deciding to invest in a different vehicle are explored below.

This structure is simply putting your investments under your own name and paying personal income tax and capital gains.

This structure is relatively straight forward and requires you to include your investment income and capital gains in your tax return annually. The amount that you pay will be determined by where you sit on the marginal tax rate ladder.

Investing as an individual gives you limited to no flexibility to redistribute income, which is one of the main benefits of a trust structure. You are able to seek a tax professional for income tax advice, but you are also able to be a self-advised individual which involves no cost or set up fees.

A trust is a person or organisation that holds assets for the benefit of beneficiaries.

Trust structures can help redistribute income, and therefore tax obligations, amongst multiple people. The most common use of trusts is for families, where income from investments can be distributed to lower income earners.

For example, there are four people in a trust. There are two high income earners on the highest marginal tax rate, and two individuals who are full time students with no income. The investment income would be better redistributed across all trust members.

Although it can distribute income, it cannot distribute any losses. The only way that these losses can be distributed is by offsetting them against gains. These losses can be offset in the same year, or carried forward to offset against future income.

Trusts can still utilise the 50% capital gains tax discount after holding an asset for 12 months.

To set up a trust, you would in most instances seek the advice of a tax professional. Trusts have set up costs, administration costs and ongoing costs.

Investment companies are also known as ‘bucket’ companies. The major difference of setting up a company is that it is a distinct, separate entity. The profits and debts that are held by the company in the process of investing do not become the profits and debts of the individuals.

The tax rate is also 25% or 30% (dependent on circumstances), which is preferable to the higher marginal tax rates. The main circumstances that determine whether you are eligible for the 25% tax rate are:

We encourage long-term investing over trading. Long term investors will receive the 30% tax rate for companies.

Companies are not eligibly for a CGT discount like individuals and trusts.

To set up a company, you would seek the advice of a tax professional. Companies have initial set up costs, ongoing advice and administration costs.

Sometimes, investors utilise a structure with both a trust and a company. Trusts can own the shares in an investment company, and this allows flexibility for the on flow of income/profit to all trust members. This is not just useful for a case where there are large disparities in income and therefore tax rate. It can be especially useful for individuals who may have career breaks due to caring responsibilities where income may be redistributed.

The other case is when the trust distributes profits to the company, and the company pays the 25% or 30% tax rate. This cash is then used to invest in assets, and can provide franked income in the future.

Here are a few key situations when you might want to consider selling shares:

#1: You’re getting close to retirement and need to de-risk.

The ability to absorb big losses in our share portfolios declines as we get close to retirement.

It’s therefore wise to begin building out positions in cash and bonds. If a lousy market materialises early in retirement, you can “spend through” those rather than selling off shares at an unfavourable time.

#2: A share’s price becomes overvalued

Morningstar estimates a ‘fair value’ for a stock depending on how much cash we think the company will generate in the future.

What the fair value estimate allows investors to do is look beyond the present market value of a stock, and understand the long-term intrinsic value.

When a company is trading above its intrinsic value, you may want to sell and look for other undervalued opportunities.

#3: You are not longer confident in your original thesis

We encourage investors to understand why they are investing in the company.

If you are not confident in your original thesis (for example, because the company has recently changed its strategy), then it may be time to reconsider your investment.

However, understand that as humans, we are prone to confirmation bias—we often want our theses to be correct, and we seek out information to prove our point. A healthy exercise is playing devil’s advocate—if you are buying a company, someone else is selling it (and vice versa). Why would they want to sell?

A great aid to help you do this is Morningstar Investor’s share research reports (sign up for a FREE 4-week trial^ to get access. No credit card needed). These reports contain our view on over 1,600 ASX and Global shares with detailed analysis on Morningstar star ratings, price / fair value, business outlook, economic moat rating changes, risks and uncertainties and more.

Morningstar Investor’s stock research reports help you evaluate a company’s long-term fundamentals

#4: The share no longer aligns with your portfolio’s goal

Investments are a means to an end—in this case, to reach investing goals. The goal of your portfolio might be lowering volatility while beating inflation, deriving income or capital growth.

These are the underlying reasons for which you choose an investment.

If the share is no longer helping you achieve your goal, then it may be time to consider letting it go and finding something else more suitable.

#5: You have tax losses

Granted, this is a niche case. But for investors who recently purchased shares that have subsequently declined, selling to harvest a tax loss can be a way to find a silver lining.

Those losses can be used to offset capital gains or, if losses exceed gains, income. Just be sure to consider the wash sale rule if you’d like to maintain ongoing exposure to an asset. If you plan to rebuy the same or a “substantially identical” security within a short timeframe of making the sale, you’ll disqualify the tax loss.

See our current best stock picks, medallist ETFs and funds, inside Morningstar Investor.

Dive deeper into how to identify stocks likely to have a reliable stream of dividends, how to identify stocks with the potential to grow their dividends over time, investing for income overseas, and more.

Morningstar Investor gives you access to our analyst forecasts for ASX200 stocks. This includes forecasts for the next two years on dividend per share, payout rate, franking and PE ratio. These projections, although not guaranteed, can add structure to investment and goal planning for investors reliant on dividend income streams.

You’ll also see key information, including dividend history, dates, grossed-up yield, payout ratio, franking percentage and more.

Screen over 48,000 ASX and global companies to find stocks which meet your investment criteria. Comprehensive, easy-to-use filters allow you to find companies meeting your criteria such as sector, size (e.g. blue chip, small cap), dividend yield, franking percentage, Morningstar rating and more.

Detailed analyst reports on over 1,600 companies allow you to understand the long-term fundamentals and outlook for the business before making an investment decision.

Morningstar Investor’s professional-grade portfolio manager, powered by Sharesight, simplifies portfolio tracking. Track investments including dividends and distributions from over 240,000 global shares, ETFs and managed funds, going back up to 20 years. View all your investments in one place, understand your portfolio’s true performance, track reinvested dividends and plan future income with upcoming dividend reporting.

Learn the fundamentals of investing, take a deep dive of concepts and learn practical explanations, tools and resources that will allow you to invest confidently. [Listen now]