When you don’t have access to an employer-sponsored retirement account – like a 401(k) or a 403(b) – you can save for retirement by opening an IRA. Your contributions may be tax-deductible, meaning you can use them to lower your income tax bill. If you want are getting a tax break for IRA contributions, you will receive IRS Form 5498. Never heard of it? Here’s what you need to know. A financial advisor could help optimize your tax strategy for your financial needs and goals.

A financial advisor may be able to help. Match with an advisor serving your area today.

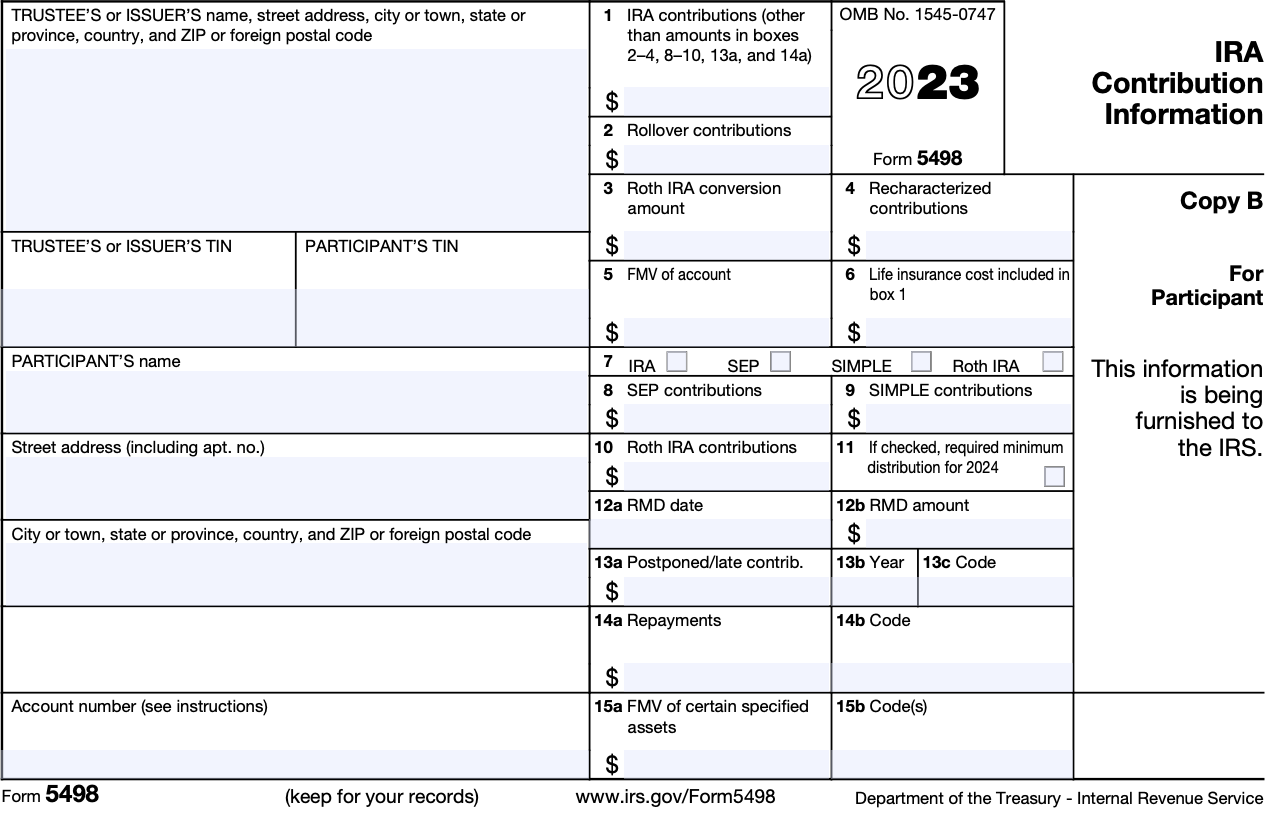

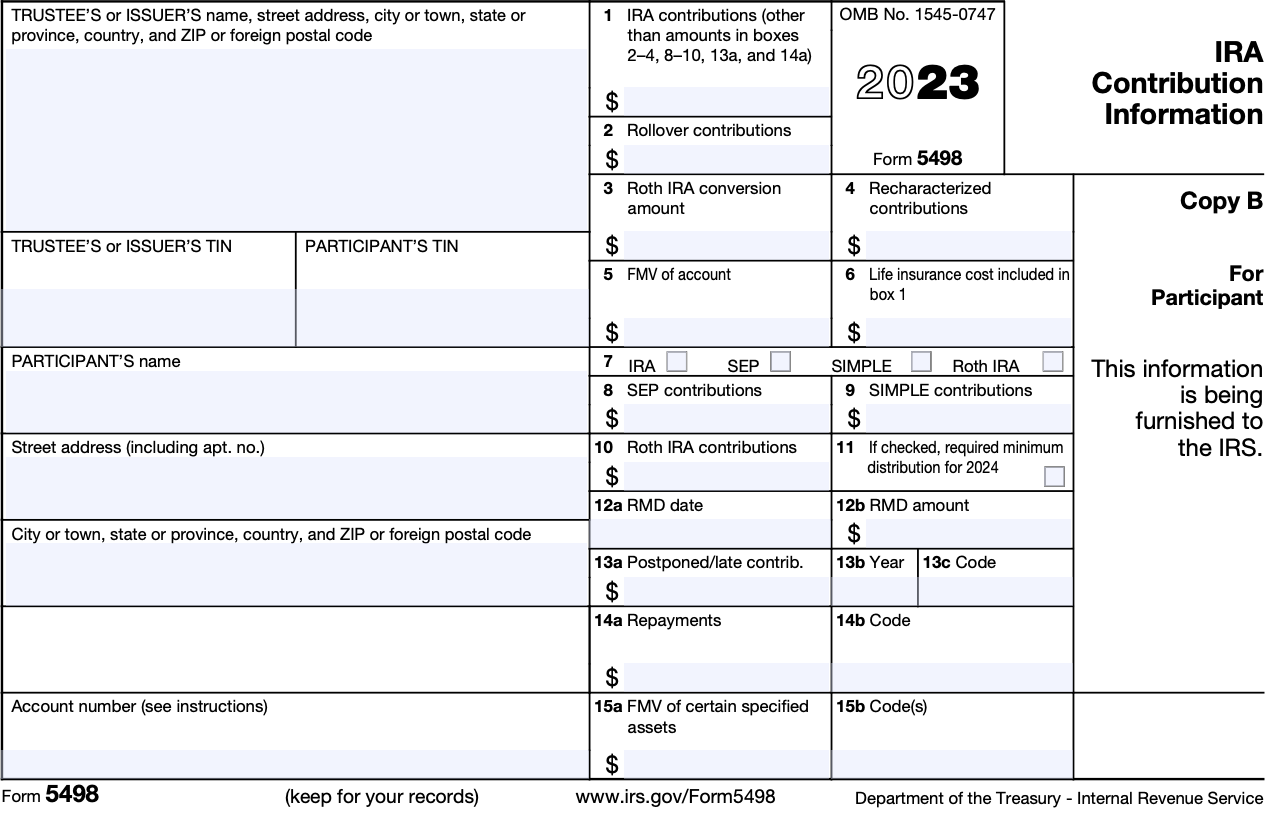

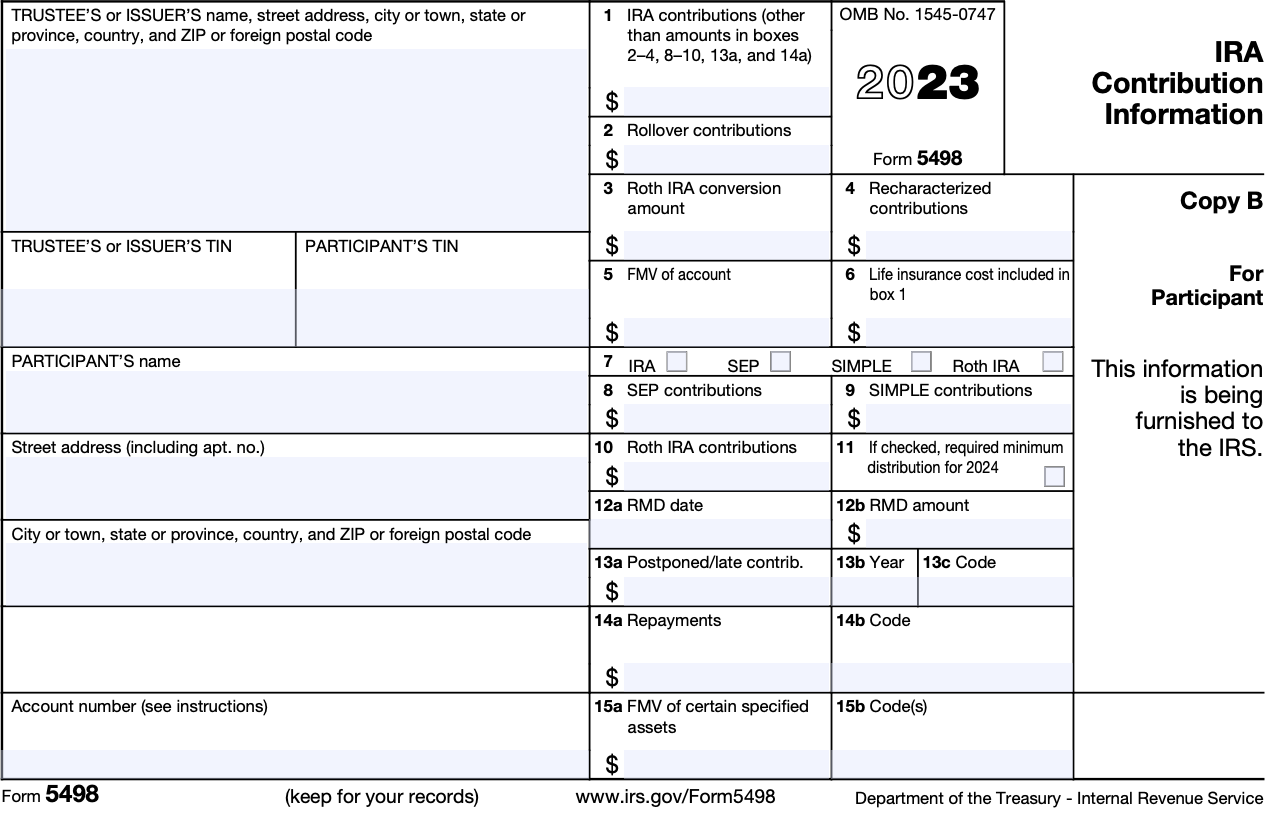

IRS Form 5498 is the IRA Contribution Information form. This tax form provides details about contributions you’ve made throughout the year to traditional and Roth IRAs. You’ll also find details about any contributions you’ve made through a Savings Incentive Match Plan for Employees (SIMPLE IRA) or a Simplified Employee Pension (SEP-IRA).

If you have an IRA, the company or financial institution that manages your retirement account (also known as your custodian) may be required to send you a copy of Form 5498. But you may not receive the form until May 31, particularly if you make a last-minute contribution to a traditional IRA (more on that below).

Form 5498 will list your IRA trustee or issuer’s name, address and federal identification number. Your name, address and Social Security number will also appear on the left side of the form.

Box 1 – located on the right side of the form – will list the total amount of contributions you’ve made to a traditional IRA. Other boxes on the form will list the amounts that you’ve contributed to your Roth IRA (box 10), your SIMPLE IRA (box 9) and your SEP-IRA (box 8).

Box 2 will report the amount of money that you’ve moved into an IRA from another retirement account via an IRA rollover. But this number won’t include any amount that you rolled over via a trustee-to-trustee transfer. These kinds of rollovers (also known as direct transfers) aren’t subject to an IRS rule that prohibits you from making more than one rollover between IRAs within a 12-month period.

Form 5498 also reports Roth IRA conversion amounts (box 3) and recharacterized contributions (box 4). The former refers to any amount of money transferred into a Roth IRA from a SEP-IRA, a SIMPLE IRA or a traditional IRA. The latter refers to any amount of money that you moved back into an IRA following a conversion you changed your mind about making.

Rollover and conversion amounts cannot be deducted on your income tax return. But technically they count as contributions. That’s why you’ll find them on Form 5498.

If you’re required to take any distributions (because you inherited an IRA or you turned 70.5), you’ll find the date and amount that should be taken in boxes 12a and 12b, respectively. A checkmark in box 11 means you have to abide by rules for required minimum distributions (RMDs) during the following year. So if the box is checked on Form 5498 for 2023, you’ll have to take an RMD for 2024. Even if the box isn’t checked, you could be subject to a 50% excise tax for ignoring the RMD rule.

Whether you need Form 5498 to file taxes depends on the kind of IRA you have. Whatever the form says you’ve contributed to your IRA could affect how much you can deduct when filing taxes.

Traditional IRAs are tax-deferred retirement accounts. You make contributions with pre-tax dollars and you don’t pay taxes on the money until you begin withdrawing it in retirement (or after you turn 70.5). In the meantime, you may be able to get a tax deduction for your contributions listed on Form 5498.

Not all IRA contributions are tax-deductible, however. You can’t get a tax break for saving money in a Roth IRA because whatever contributions you make come from after-tax dollars. Even though Form 5498 reports Roth IRA contribution information, you won’t need the form to file taxes unless you’re trying to qualify for the Retirement Savings Contributions Credit (Saver’s Credit).

Only employers can claim a tax deduction for the SEP-IRA and SIMPLE IRA contributions listed on Form 5498. If you own your own business, there are rules regarding how much you can deduct. Having a SEP-IRA may limit your ability to claim a deduction for making traditional IRA contributions.

Form 5498 will not say anything about deduction limits or whether you qualify for a tax deduction. You’ll have to check the IRS website for that information.

If you need Form 5498, your trustee must send it to you by May 31. Make sure to contact your IRA custodian if you find any errors on the form. If you receive the form after you’ve already filed taxes and you realize that you didn’t deduct the correct amount on your tax return, you might need to file an amended tax return.

You should not submit Form 5498 along with your income tax return. The IRS will receive its own copy of the form from your IRA trustee. The copy you receive in the mail is yours to keep.

If you’re claiming a tax deduction on your tax return, you can use Form 5498 to verify that it’s the same as the amount you thought you contributed. Then you can figure out how much to deduct based on the kind of IRA you have, your filing status, your annual income and whether or not you (or your spouse) have a retirement account at work. You can also use Form 5498 to figure out how much you need to withdraw from your IRA(s) in order to comply with the guidelines for RMDs.

Even if you receive 5498 after Tax Day, it’s a good idea to review it and compare it to what you included on your tax return. Keep in mind that Form 5498 reports any contributions you’ve made throughout a single tax year and through the April filing deadline of the following tax year. If you’re only looking at the IRA contributions you’ve made through the end of the year, your numbers might differ from the ones on Form 5498.

You can potentially score a tax break for the previous tax year as long as you make a contribution to a traditional IRA before Tax Day. So if you open an IRA by December 31, don’t forget to find out whether you can deduct that contribution on your tax return that’s due in April.

Form 5498 will tell you what you’ve contributed to various IRAs during the year. The form will also list rollover contributions, recharacterized contributions, conversion amounts, required minimum distributions and the fair market value of your investments at the end of the year. Your IRA trustee – not you – will be responsible for getting the numbers on the form to the IRS.

While Form 5498 provides you with plenty of useful information, you don’t necessarily need it to file taxes. If the form doesn’t arrive by the time you file your taxes, refer to the statements from your IRA custodian. You should be able to calculate how much you contributed over the previous year. Then you can figure out how much you can deduct.

Photo credit: ©iStock.com/Tatomm, Internal Revenue Service, ©iStock.com/DragonImages

Amanda DixonAmanda Dixon is a personal finance writer and editor with an expertise in taxes and banking. She studied journalism and sociology at the University of Georgia. Her work has been featured in Business Insider, AOL, Bankrate, The Huffington Post, Fox Business News, Mashable and CBS News. Born and raised in metro Atlanta, Amanda currently lives in Brooklyn.

Read More About Taxes

More from SmartAsset

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. SmartAsset's services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. SmartAsset receives compensation from Advisers for our services. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any user's account by an Adviser or provide advice regarding specific investments.

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors.

This is not an offer to buy or sell any security or interest. All investing involves risk, including loss of principal. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.